1. Trends in the Number of Tourists in Kyoto City (2000-2023)

Changes in the Total Number of Tourists in Kyoto City

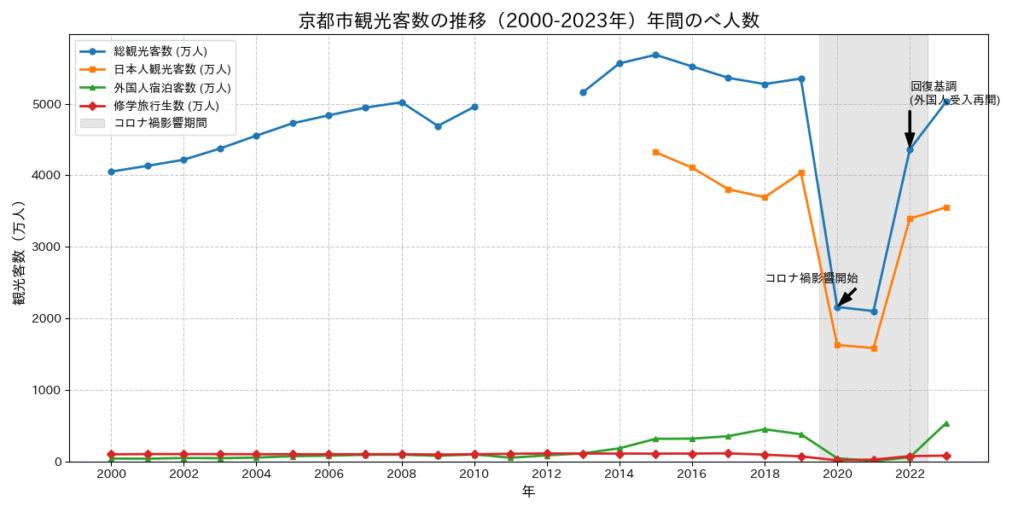

The number of tourists in Kyoto City steadily increased from around 2000, reaching a peak before the COVID-19 pandemic with approximately 52.75 million visitors in 2018 and 53.52 million in 2019. However, due to the pandemic, the numbers significantly decreased in 2020 and 2021, dropping to about 21.02 million in 2021. Since then, it has been recovering, reaching approximately 50.28 million in 2023.

Changes in the Number of Overnight Visitors

- Japanese Overnight Visitors: Showed a slight increase from approximately 9.02 million in 2000 to 9.37 million in 2019. After a significant drop during the pandemic, the number recovered to pre-pandemic levels in 2023 with approximately 9.39 million visitors.

- Foreign Overnight Visitors: Increased more than tenfold from approximately 0.4 million in 2000 to 4.5 million in 2018. It sharply dropped to about 0.05 million in 2021 due to the pandemic but recovered significantly to approximately 5.36 million in 2023, far exceeding pre-pandemic levels.

- School Excursion Students: Decreased from approximately 0.95 million in 2018 to 0.7 million in 2019. After a major drop during the pandemic, the number recovered to about 0.81 million in 2023, exceeding the pre-pandemic level. *This refers to school trips for Japanese students.*

2. Monthly Tourist Numbers in 2023

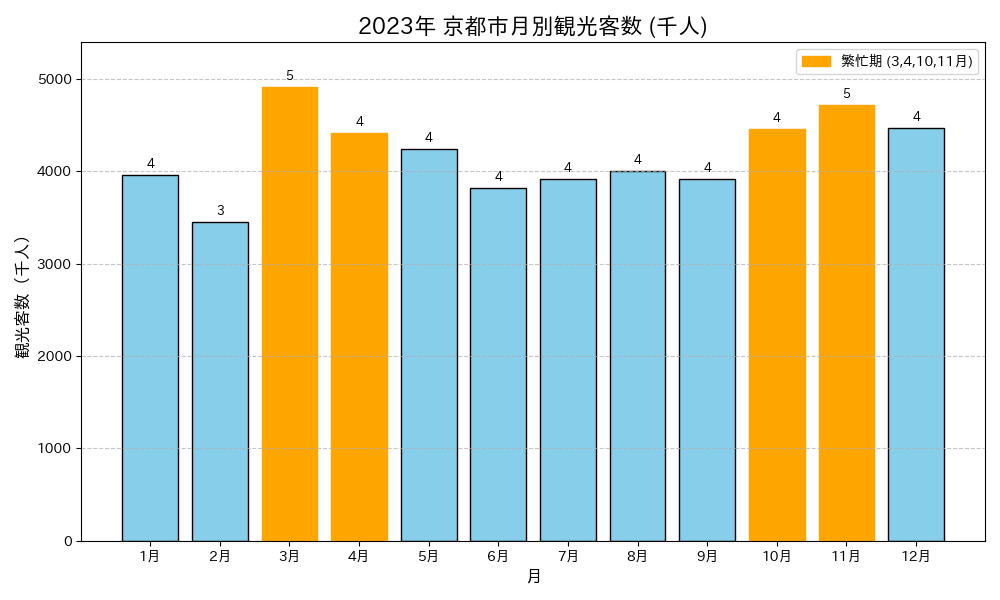

The monthly tourist numbers for 2023 are as follows (in thousands):

The data shows that the number of tourists is particularly high in spring (March) and autumn (October to November), with peaks in March and November. February has the fewest tourists.

3. Trends in Japanese Tourists

Time-Series Trends

The number of Japanese tourists was approximately 44.66 million in 2019 but decreased significantly due to the pandemic. By 2023, it had recovered to about 43.19 million, which is approximately 97% of the pre-pandemic level.

Notable Changes from 2023 to 2024

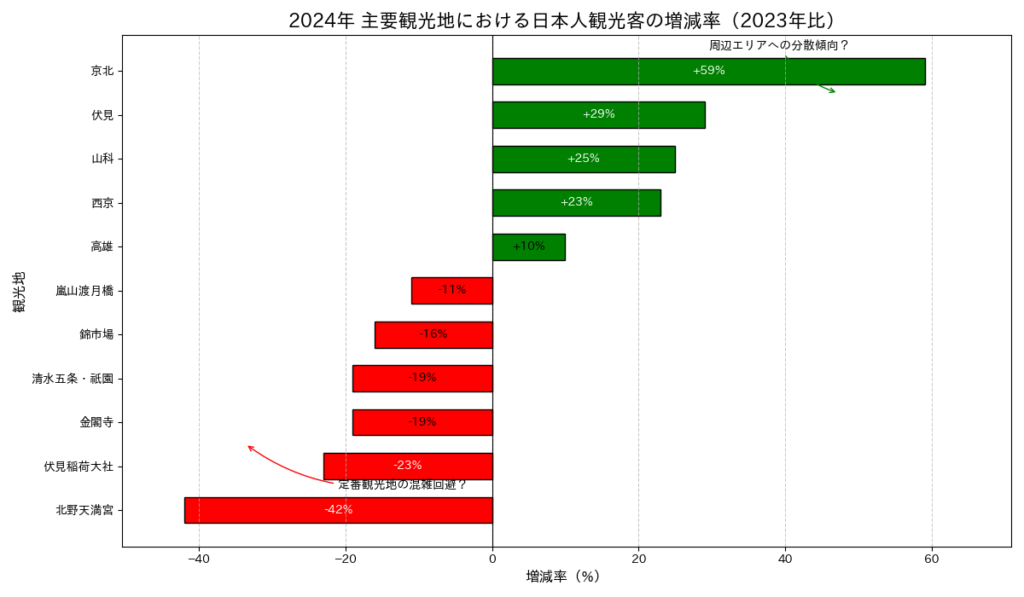

A notable change was observed in Japanese tourists in a survey conducted by Kyoto City in autumn 2024. While the number of Japanese tourists at famous sightseeing spots decreased by about 15% year-on-year, the number of foreign tourists increased by about 30% during the same period.

The sightseeing spots with the highest decrease rates were:

- Kitano Tenmangu Shrine: -42% year-on-year

- Fushimi Inari Taisha Shrine: -23% year-on-year

- Kiyomizu-Gojo and Gion Hanamikoji: -19% year-on-year

- Kinkaku-ji Temple: -19% year-on-year

- Nishiki Market: -16% year-on-year

- Arashiyama’s Togetsukyo Bridge: -11% year-on-year

On the other hand, areas where the number of Japanese tourists increased were:

- Keihoku Area: +59% year-on-year

- Fushimi (excluding Fushimi Inari Taisha): +29% year-on-year

- Yamashina: +25% year-on-year

- Saikyo: +23% year-on-year

- Takao: +10% year-on-year

This phenomenon indicates that Japanese tourists are shifting from central Kyoto to suburban or less-known areas to avoid the congestion caused by the sharp increase in foreign tourists. Comments like “I don’t want to go to the city center” have been heard, suggesting a reaction by Japanese tourists to overtourism.

4. Trends in Foreign Tourists

Time-Series Trends

The number of foreign tourists (overnight visitors) rapidly increased to approximately 4.5 million in 2018, plummeted during the pandemic, but recorded a new high of about 5.36 million in 2023, an increase of about 41% compared to the pre-pandemic period.

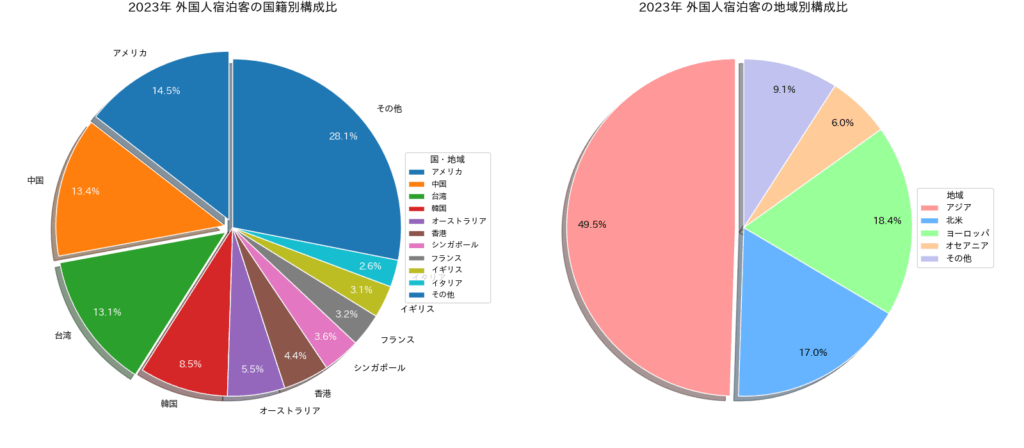

Composition by Nationality (2023)

The breakdown of foreign overnight visitors by nationality in 2023 (actual numbers in thousands):

- United States: 779 thousand

- China: 716 thousand

- Taiwan: 704 thousand

- South Korea: 454 thousand

- Australia: 294 thousand

- Hong Kong: 235 thousand

- Singapore: 193 thousand

- France: 171 thousand

- United Kingdom: 168 thousand

- Italy: 141 thousand

Composition by region:

- Asia: 49.5%

- Europe: 18.4%

- North America: 17.0%

- Oceania: 6.0%

- Other/Unknown: 9.1%

Tourist Spending

The amount spent by foreign tourists in 2023 was approximately 508.4 billion yen (compared to 331.8 billion yen in 2019). The average spending per person was 71,661 yen overall, with overnight visitors spending 87,208 yen and day-trippers spending 23,726 yen.

2024 Trends

Foreign tourist numbers continued to increase in 2024, with a particularly high ratio of foreign visitors at famous sightseeing spots in Kyoto City. A survey in autumn 2024 showed an increase of about 30% compared to the same period the previous year.

5. Trends in School Excursions

Time-Series Trends

The number of students on school excursions was approximately 0.99 million in 2000 and 0.95 million in 2018, but it decreased to about 0.7 million in 2019. After a significant drop during the pandemic, it recovered to about 0.81 million in 2023, an increase of about 15% compared to 2019.

2023 Detailed Data

- Total: 810,537 people

- Elementary School: 131,251 (16.2%)

- Junior High School: 500,579 (61.8%)

- High School: 178,707 (22.0%)

- Average Length of Stay: 1.63 nights

- Elementary School: 1.11 nights

- Junior High School: 1.72 nights

- High School: 1.74 nights

Composition by Origin (2023)

- Elementary School: The top regions were Chubu (70.9%), Kinki (14.0%), and Chugoku (7.5%).

- Junior High School: The top regions were Kanto (56.0%), Kyushu/Okinawa (17.1%), and Chubu (15.6%).

- High School: The top regions were Kanto (32.8%), Tohoku (31.1%), and Hokkaido (15.3%).

Overall, school excursions are most common from Kanto (42.1%), Chubu (23.6%), and Kyushu/Okinawa (12.2%).

6. Status of Accommodations (2024)

The status of accommodations in Kyoto City in 2024 is as follows:

- Occupancy Rate: 78.5% (an increase from 73.4% in 2023, but not yet reaching 81.3% from 2019)

- Average Room Rate: 20,195 yen (a new record, exceeding 17,403 yen in 2023 and 15,610 yen in 2019)

- Revenue Per Available Room (RevPAR): 15,853 yen (a new record, exceeding 12,774 yen in 2023 and 12,691 yen in 2019)

These data suggest that accommodation providers are shifting their business strategy from “quantity to quality,” as evidenced by the rise in room rates.

7. Tourist Spending and Economic Impact

Tourist spending in 2023 was 1.5366 trillion yen (a 24.3% increase from 2019), and the economic ripple effect was 1.7014 trillion yen (a 25.4% increase from 2019). Both figures set new records, largely attributed to the increase in spending by foreign tourists.

8. Latest Challenges and Responses

The Overtourism Problem

To mitigate congestion caused by the sharp increase in foreign tourists, Kyoto City is implementing the following measures:

- Dispersal of tourists by season, time, and location

- Visualization of congestion levels and tourist comfort

- Transportation measures (such as preventing tour buses from idling on the street)

- Measures to alleviate congestion on city buses

The “Segregation” Phenomenon Between Japanese and Foreign Tourists

A prominent feature in 2024 is the increasing “segregation” between Japanese and foreign tourists. Japanese tourists are shifting to lesser-known spots and suburban areas to avoid crowds, with areas like Keihoku becoming new popular destinations.

Summary

Kyoto’s tourism situation can be said to have entered a new phase after recovering from the pandemic since 2023. While the number of foreign tourists and their spending have significantly surpassed pre-pandemic levels, a new challenge has emerged: Japanese tourists are “moving away from” classic sightseeing spots.

The number of school excursion students has also recovered, and tourist spending has increased due to higher accommodation rates. However, the overtourism problem is becoming more severe, especially at famous sightseeing spots. Kyoto City is implementing measures to achieve “sustainable Kyoto tourism” that balances tourism with the daily lives of its residents.

Going forward, it will be important to promote the dispersal of tourists and create diverse tourism content that leverages Kyoto’s various attractions. Additionally, a key challenge is to create an environment where both Japanese and foreign tourists can enjoy different aspects of Kyoto’s charm.